Features

- Full coverage

- Octarisk covers the full market risk spectrum from start to finish: risk factor calibration, instrument and market data setup, Monte-Carlo scenario generation, stress testing, full instrument valuation, portfolio aggregation and graphical what-if instrument and position analysis with real-time revaluation and re-aggregation.

- Full valuation

- For all supported instruments the theoretical value is calculated in each scenario including a mark-to-market calibration and sensitivity calculations.

- Full scaleability

- Octarisk can be run for selected instruments with a couple of risk factors for your personal portfolio or with thousands of risk factors and several thousand instruments for your internal model full valuation approach.

- Full interactivity

- The parameter file approach allows for full user interaction. Change instrument properties and portfolio composition to get a holistic view of your portfolio risk and estimate the impact of your investment decisions. You can also feed input files from a database to have a proper lineage trail for all of your calculations.

- Free software

- No vendor lock-in and full transparency forever, since Octarisk is published under the GNU GPL. Take the code, fit it to your needs. If you contribute with new code, you profit from decentralized distributed peer review.

- Light weight

- Instrument valuation and market risk measurement is more or less matrix multiplication - so the method of choice was GNU Octave and powerful linear algebra packages. It is free, reliable and really fast, since the code is vectorized. Alternatively, you can port the code to Matlab with little effort. Octave code can be easily understood, customized and extended by most IT affine persons - no big software solution in Java is required to make instrument valuation.

- Fast

- Octarisk can be run on any desktop computer with at least 4GB of memory. It still runs in seconds for smaller portfolios. If run on big server farms with workload manager and lots of memory, you have nearly unlimited opportunities to choose your risk factors and instruments. C++ code has been used for performance critical calculation steps. Octarisk has shown its performance capability in a production scale risk measurement setup. Full valuation with 50000 MC scenarios of several thousand instruments and risk factors of a diversified portfolio has been several time faster than proprietary software solutions (under equal conditions).

Application spectrum

- Risk Management

- Use Octarisk as basis for for covering quantitative and qualitative parts of risk management and use the extensive reporting functionality to identify investment actions. See the report outputs below to find ideas for your individual risk assessment.

- Validation

- Your financial company certainly has some software solution for assessing market risk - either a commercial product or custom made. Why not using Octarisk as a real independent validation tool? Feed in the same stochastic parameters and risk factors and compare stress tests values and VaR for a representative portfolio. It doesn't cost you anything and can be done with minimal effort by your validation group.

- Impact analysis

- If you want to change your internal model, most likely you have to make impact analysis of all upcoming changes. Reassure the values you get from your delta-gamma tool and have a more robust tool at hand for calculating the impact before you apply all model changes.

- Internal Model

- If you already plan to build your own valuation software for your internal model - why not using Octarisk as a starting point? It can be easily extended and customized fitting all your needs.

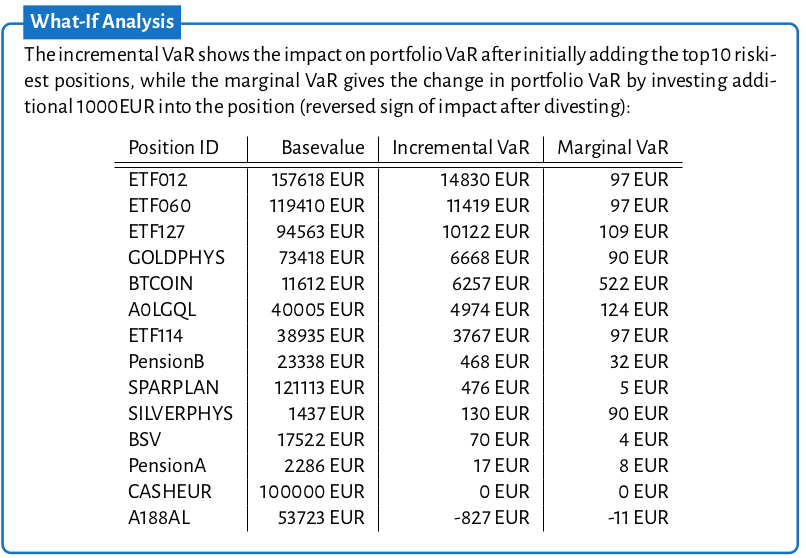

- Asset management

- Use the performance and the GUI of Octarisk to back up your investment decisions with full valuation market risk measurement. Profit from what-if analysis (change position sizes), change instrument properties (e.g. strike or maturity of your option strategy), and instantly see the impacts on your overall portfolio risk.

- Educational purposes

- You want to have an edge over your fellow students? Try Octarisk and get familiar with a full valuation market risk framework.

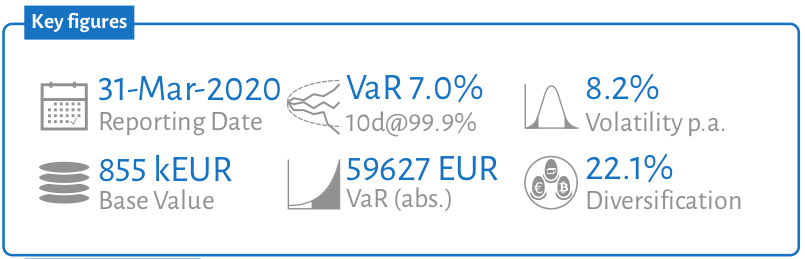

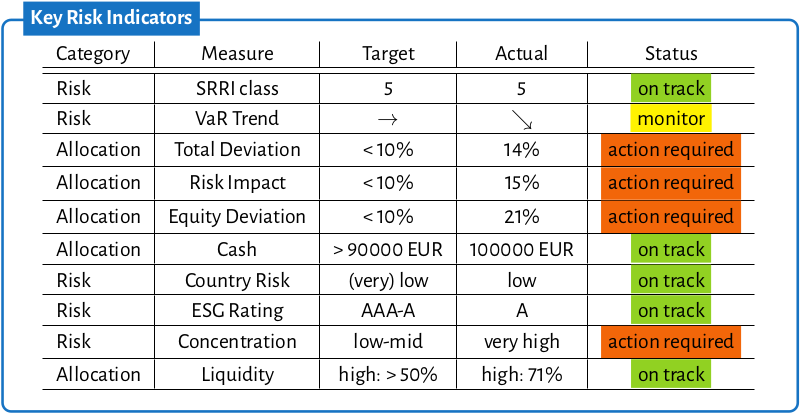

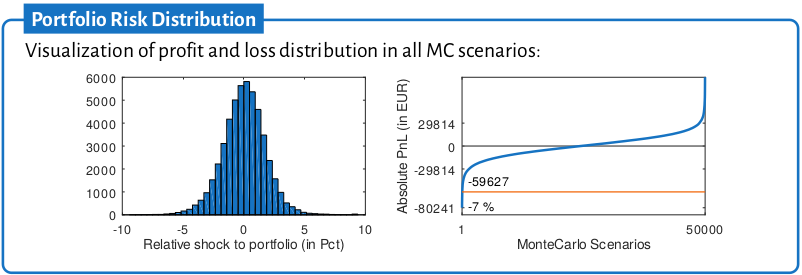

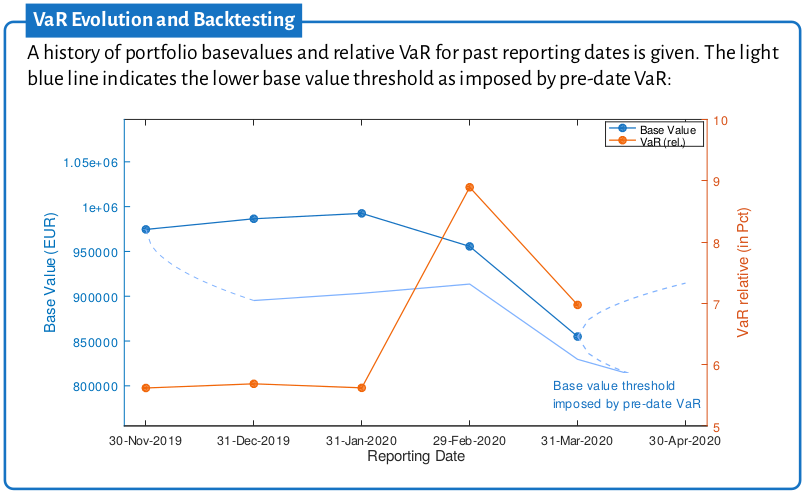

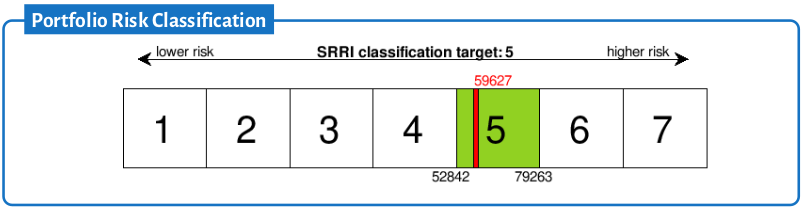

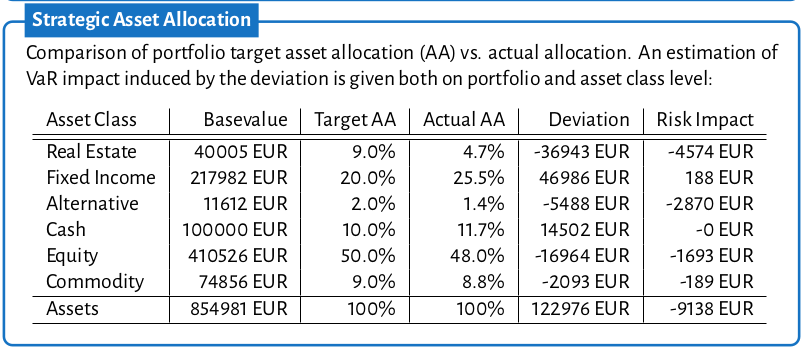

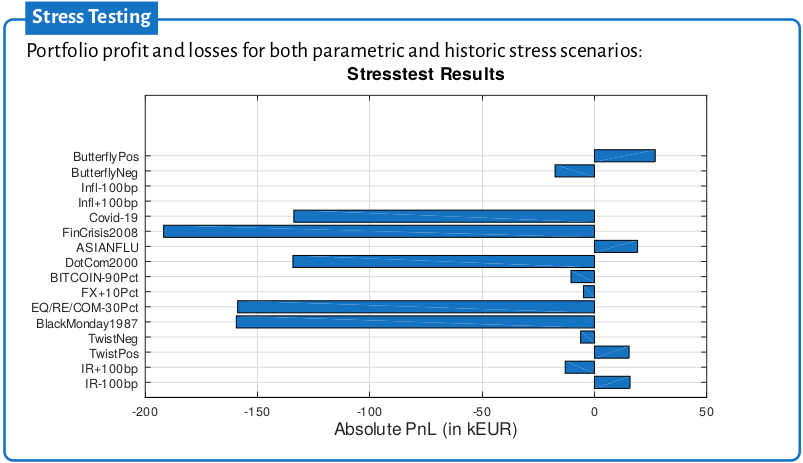

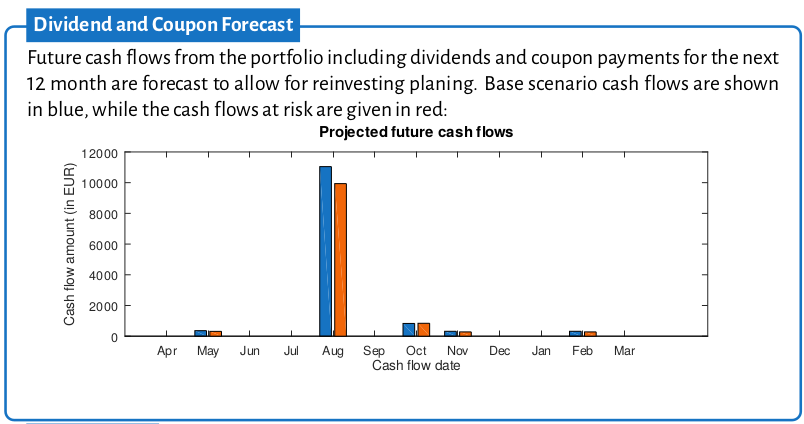

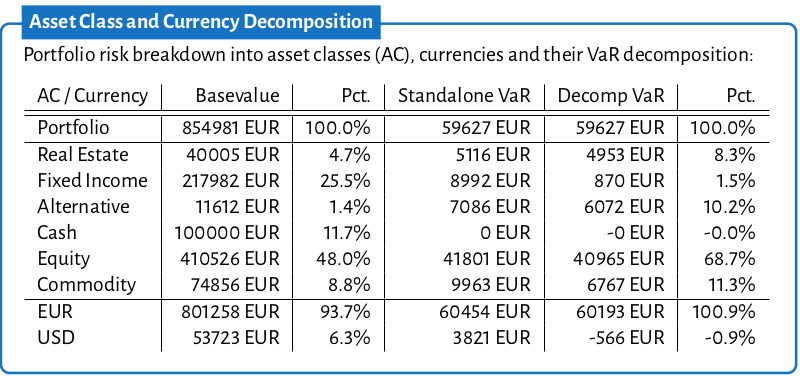

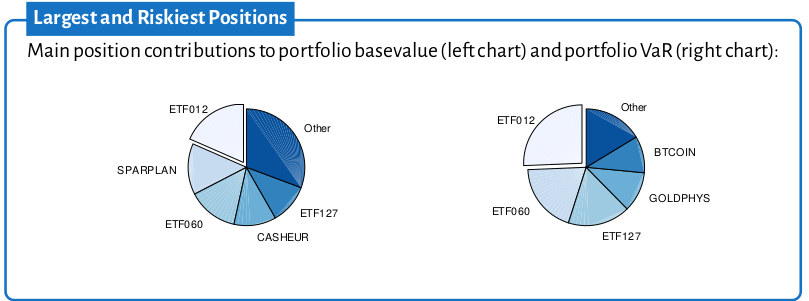

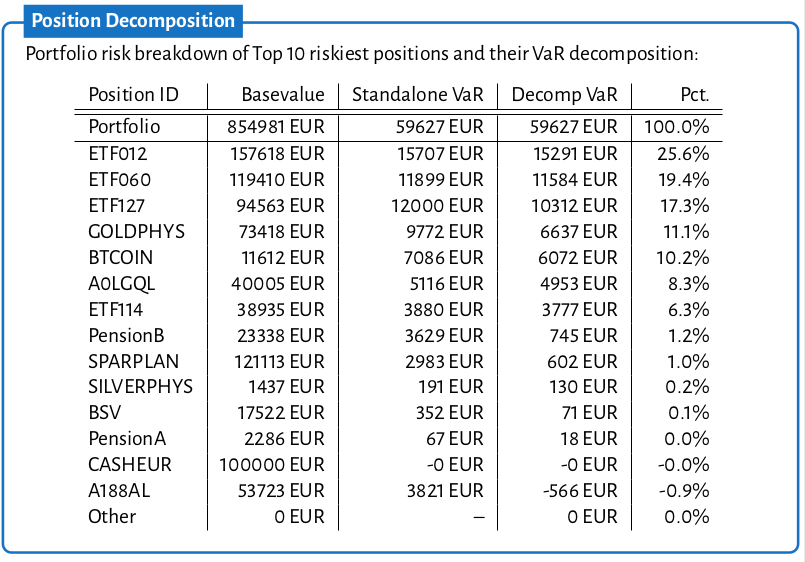

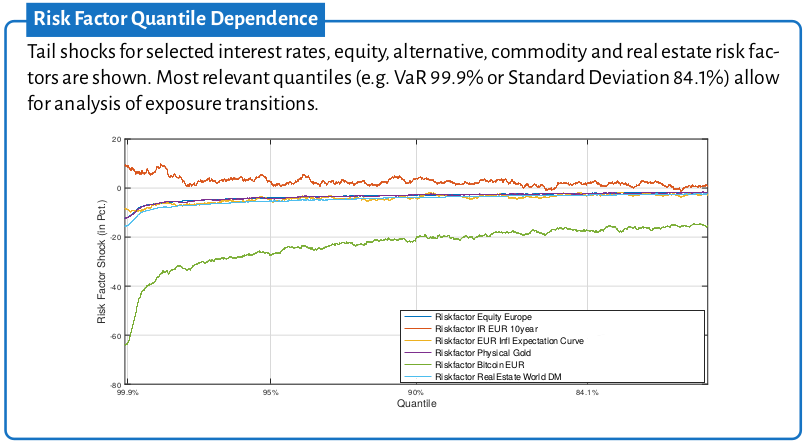

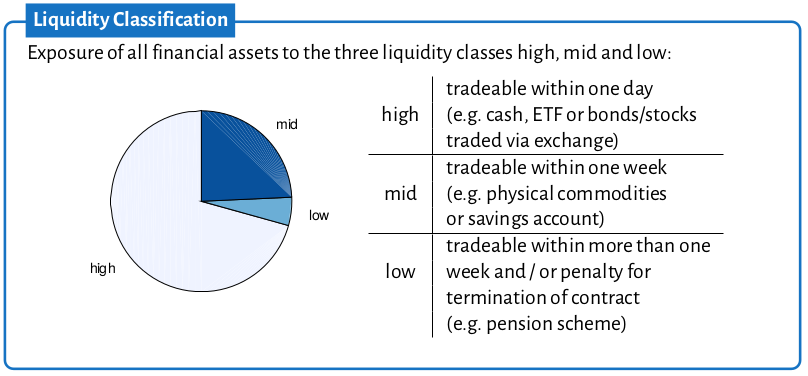

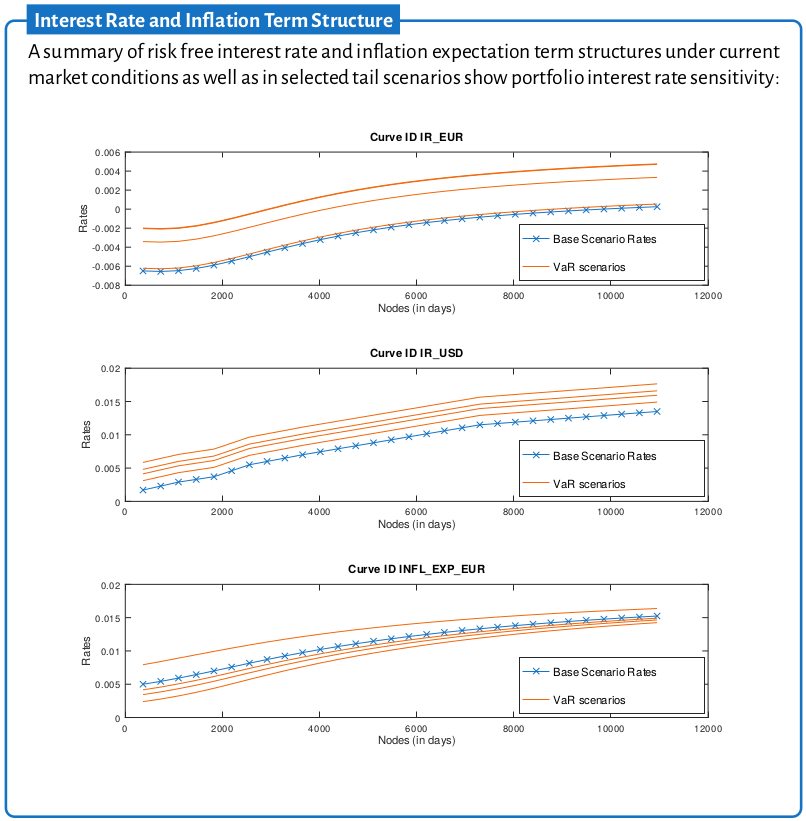

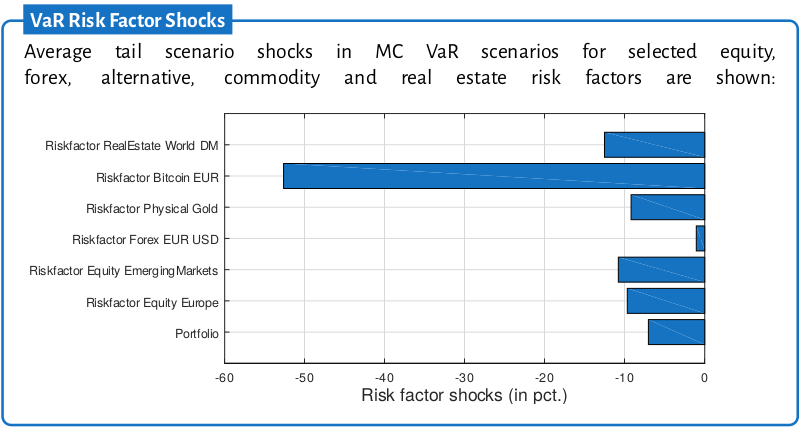

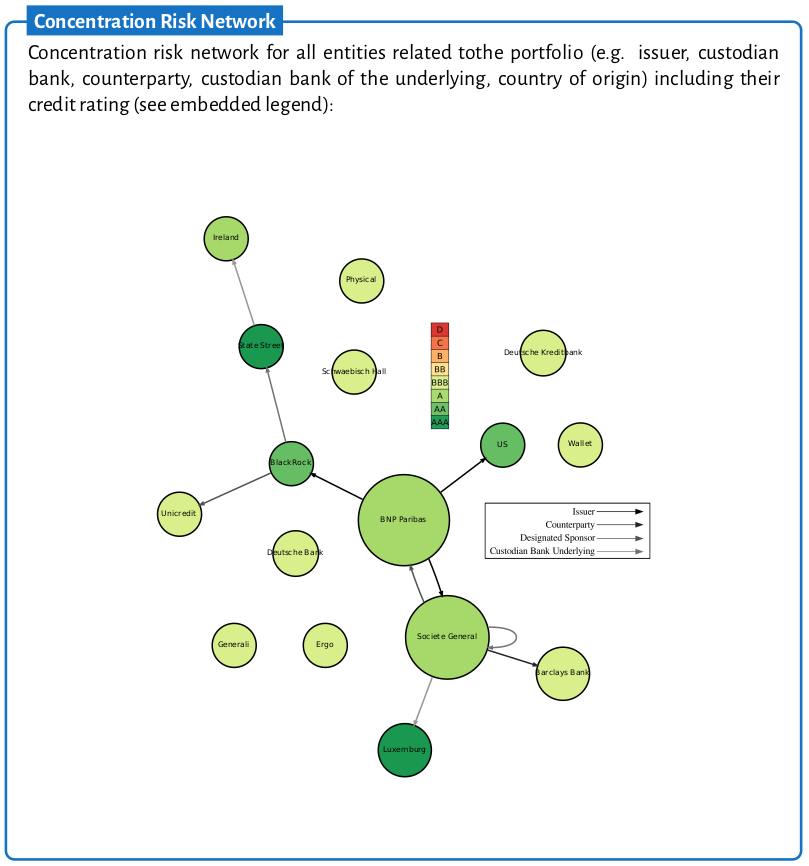

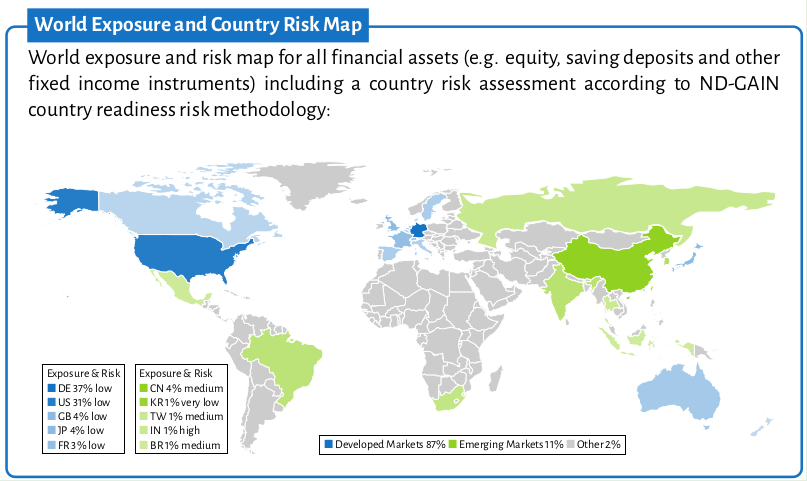

Report Outputs

Risk reporting has to be tailored to the investment objective and should ideally adress underlying risk types, give clear indication if and where action is required and should assist in monitoring and adjusting strategic and / or tactical asset allocation. Both quantitative and qualitative aspects could be taken up by proper risk reporting and allow for historic comparison and movement analysis. With @sc{octarisk} all these aspects of risk management can be covered in custom risk reports. Some impressions of the reporting capabilities of Octarisk are shown:

Many additional reports and plot are automatically generated.