Next: Stochastic.help, Previous: Surface.help, Up: Octave octarisk Classes [Contents][Index]

Class for setting up Swaption objects. Possible underlyings are fixed and floating swap legs. Therefore the following Swaption types are introduced:

In the following, all methods and attributes are explained and a code example is given.

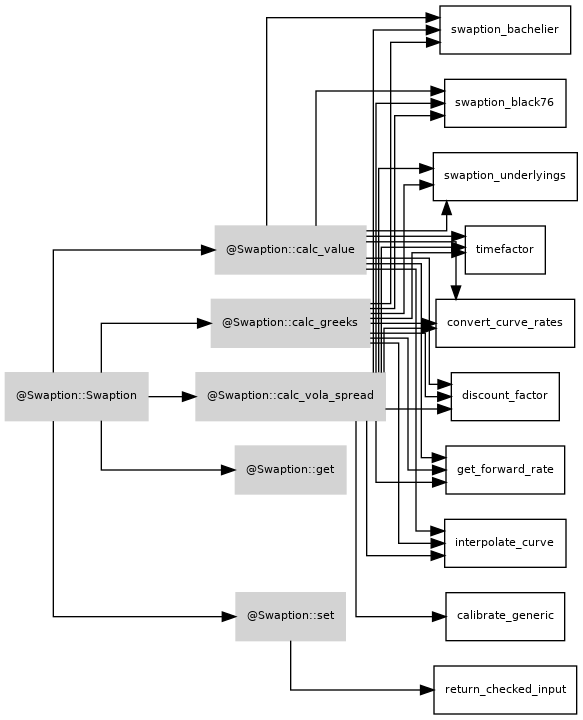

Methods for Swaption object obj:

Attributes of Swaption objects:

For illustration see the following example: A normal payer swaption with maturity in 20 years with underlying swaps starting in 20 years for 10 years, a volatility surface and a discount curve are priced. The resulting Swaption value (642.6867193851) is retrieved:

disp('Pricing Payer Swaption with underlyings (Normal Model)')

r = Curve();

r = r.set('id','EUR-SWAP-NOFLOOR','nodes', ...

[7300,7665,8030,8395,8760,9125,9490,9855,10220,10585,10900], ...

'rates_base',[0.02,0.01,0.0075,0.005,0.0025,-0.001, ...

-0.002,-0.003,-0.005,-0.0075,-0.01], ...

'method_interpolation','linear');

fix = Bond();

fix = fix.set('Name','SWAP_FIXED','coupon_rate',0.045, ...

'value_base',100,'coupon_generation_method','forward', ...

'sub_type','SWAP_FIXED');

fix = fix.set('maturity_date','24-Mar-2046','notional',100, ...

'compounding_type','simple','issue_date','26-Mar-2036', ...

'term',365,'notional_at_end',0);

fix = fix.rollout('base','31-Mar-2016');

fix = fix.rollout('stress','31-Mar-2016');

fix = fix.calc_value('31-Mar-2016','base',r);

fix = fix.calc_value('31-Mar-2016','stress',r);

float = Bond();

float = float.set('Name','SWAP_FLOAT','coupon_rate',0.00,'value_base',100, ...

'coupon_generation_method','forward','last_reset_rate',-0.000, ...

'sub_type','SWAP_FLOATING','spread',0.00);

float = float.set('maturity_date','24-Mar-2046','notional',100, ...

'compounding_type','simple','issue_date','26-Mar-2036', ...

'term',365,'notional_at_end',0);

float = float.rollout('base',r,'31-Mar-2016');

float = float.rollout('stress',r,'31-Mar-2016');

float = float.calc_value('30-Sep-2016','base',r);

float = float.calc_value('30-Sep-2016','stress',r);

v = Surface();

v = v.set('axis_x',30,'axis_x_name','TENOR', ...

'axis_y',45,'axis_y_name','TERM','axis_z',1.0,'axis_z_name','MONEYNESS');

v = v.set('values_base',0.376563388);

v = v.set('type','IRVol');

s = Swaption();

s = s.set('maturity_date','26-Mar-2036','effective_date','31-Mar-2016');

s = s.set('strike',0.045,'multiplier',1,'sub_type', 'SWAPT_PAY', ...

'model','normal','tenor',10);

s = s.set('und_fixed_leg','SWAP_FIXED','und_floating_leg','SWAP_FLOAT', ...

'use_underlyings',true);

s = s.calc_value('31-Mar-2016','base',r,v,fix,float);

s.getValue('base')

Dependencies of class:

Next: Stochastic.help, Previous: Surface.help, Up: Octave octarisk Classes [Contents][Index]