Next: Cash.help, Previous: Forward.help, Up: Octave octarisk Classes [Contents][Index]

Class for setting up Option objects. Possible underlyings are financial instruments or indizes. Therefore the following Option types are introduced:

In the following, all methods and attributes are explained and a code example is given.

Methods for Option object obj:

Attributes of Option objects:

For illustration see the following example: An American equity Option with 10 years to maturity, an underlying index, a volatility surface and a discount curve are set up and the Option value (123.043), volatility spread and the Greeks are calculated by the Willowtree model and retrieved:

disp('Pricing American Option Object (Willowtree)')

c = Curve();

c = c.set('id','IR_EUR','nodes',[730,3650,4380], ...

'rates_base',[0.0001001034,0.0045624391,0.0062559362], ...

'method_interpolation','linear');

v = Surface();

v = v.set('axis_x',3650,'axis_x_name','TERM','axis_y',1.1, ...

'axis_y_name','MONEYNESS');

v = v.set('values_base',0.210360082233);

v = v.set('type','IndexVol');

i = Index();

i = i.set('value_base',286.867623322,'currency','USD');

o = Option();

o = o.set('maturity_date','29-Mar-2026','currency','USD', ...

'timesteps_size',5,'willowtree_nodes',30);

o = o.set('strike',368.7362,'multiplier',1,'sub_Type','OPT_AM_P');

o = o.set('pricing_function_american','Willowtree');

o = o.calc_value('31-Mar-2016','base',i,c,v);

o = o.calc_greeks('31-Mar-2016','base',i,c,v);

value_base = o.getValue('base')

theo_omega = o.get('theo_omega')

disp('Calibrating volatility spread over yield:')

o = o.set('value_base',100);

o = o.calc_vola_spread('31-Mar-2016',i,c,v);

o.getValue('base')

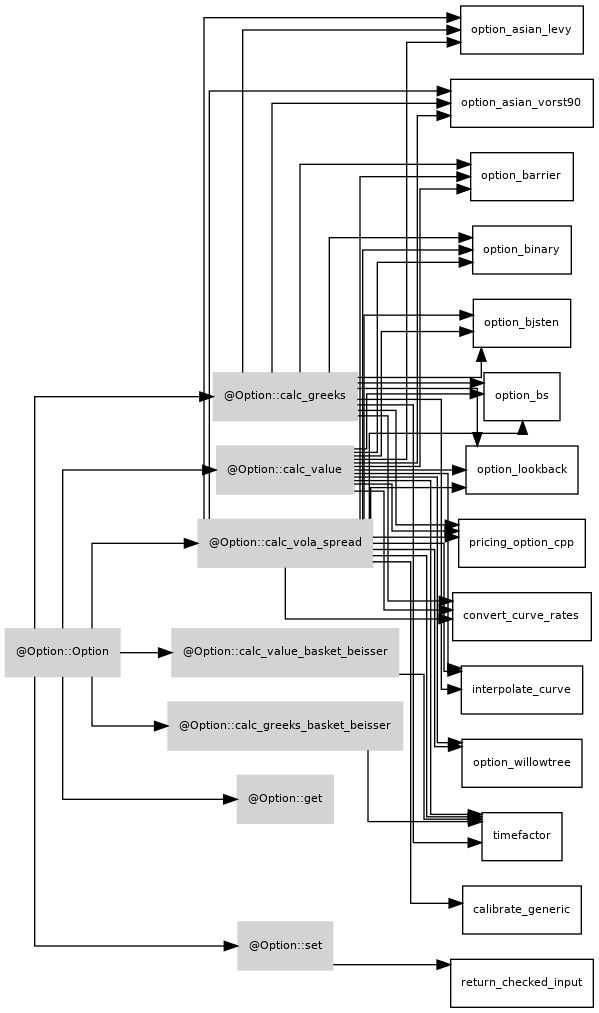

Dependencies of class:

Next: Cash.help, Previous: Forward.help, Up: Octave octarisk Classes [Contents][Index]