Class for setting up Cash objects.

This class contains all attributes and methods related to the following Cash types:

- Cash: Specify riskless cash instruments

In the following, all methods and attributes are explained and a code example is given.

Methods for Cash object obj:

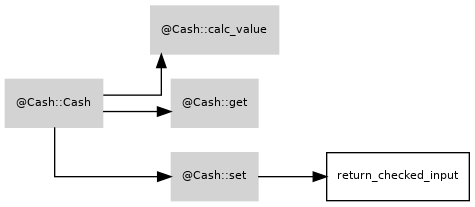

- Cash(id) or Cash(): Constructor of a Cash object. id is optional and specifies id and name of new object.

- obj.set(attribute,value): Setter method. Provide pairs of attributes and values. Values are checked for format and constraints.

- obj.get(attribute): Getter method. Query the value of specified attribute.

- obj.calc_value(scenario,scen_number): Extends base value to vector of row size scen_number

and stores vector for given scenario. Cash instruments are per definition risk free.

- obj.getValue(scenario): Return Cash value for given scenario.

Method inherited from Superclass Instrument

- Cash.help(format,returnflag): show this message. Format can be [plain text, html or texinfo].

If empty, defaults to plain text. Returnflag is boolean: True returns

documentation string, false (default) returns empty string. [static method]

Attributes of Cash objects:

- id: Instrument id. Has to be unique identifier. Default: empty string.

- name: Instrument name. Default: empty string.

- description: Instrument description. Default: empty string.

- value_base: Base value of instrument of type real numeric. Default: 0.0.

- currency: Currency of instrument of type string. Default: ’EUR’

During instrument valuation and aggregation, FX conversion takes place if corresponding FX rate is available.

- asset_class: Asset class of instrument. Default: ’unknown’

- type: Type of instrument, specific for class. Set to ’cash’.

- value_stress: Line vector with instrument stress scenario values.

- value_mc: Line vector with instrument scenario values.

MC values for several timestep_mc are stored in columns.

- timestep_mc: String Cell array with MC timesteps. If new timesteps are set, values are automatically appended.

For illustration see the following example:

A THB Cash instrument is being generated and during value calculation the stress and MC scenario values

with 20 resp. 1000 scenarios are derived from the base value:

c = Cash();

c = c.set('id','THB_CASH','name','Cash Position THB');

c = c.set('asset_class','cash','currency','THB');

c = c.set('value_base',346234.1256);

c = c.calc_value('stress',20);

c = c.calc_value('250d',1000);

value_stress = c.getValue('stress');