Next: Developer guide, Previous: Aggregation, Up: User guide [Contents][Index]

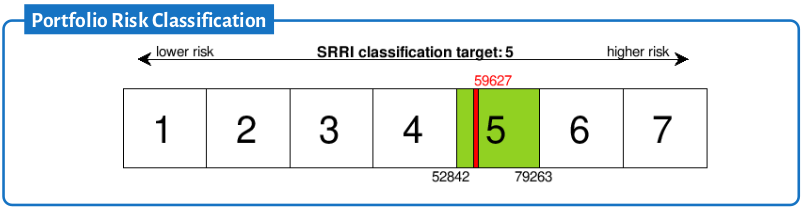

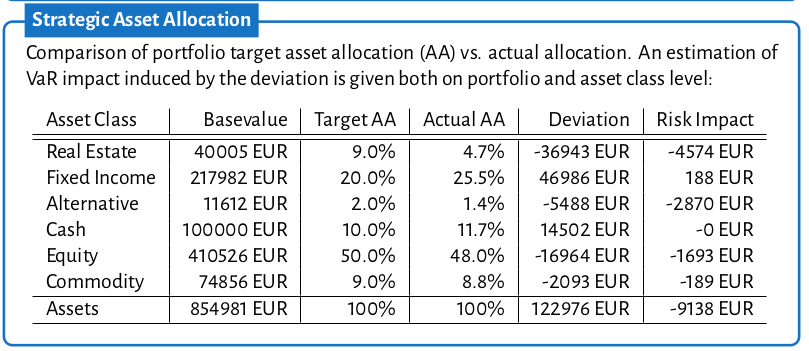

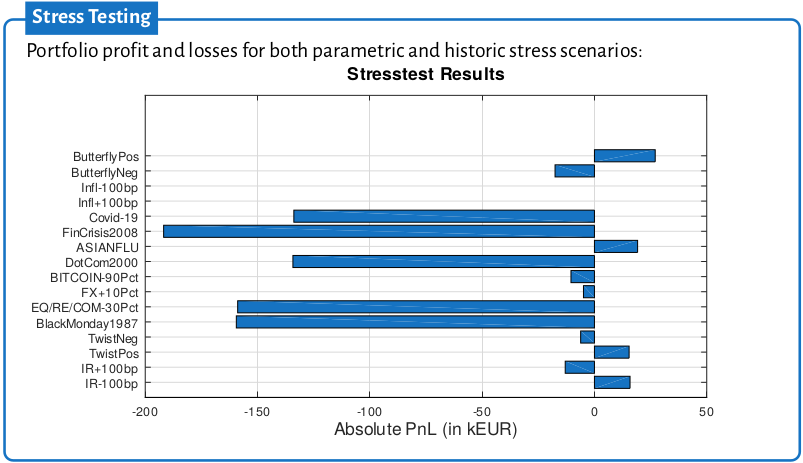

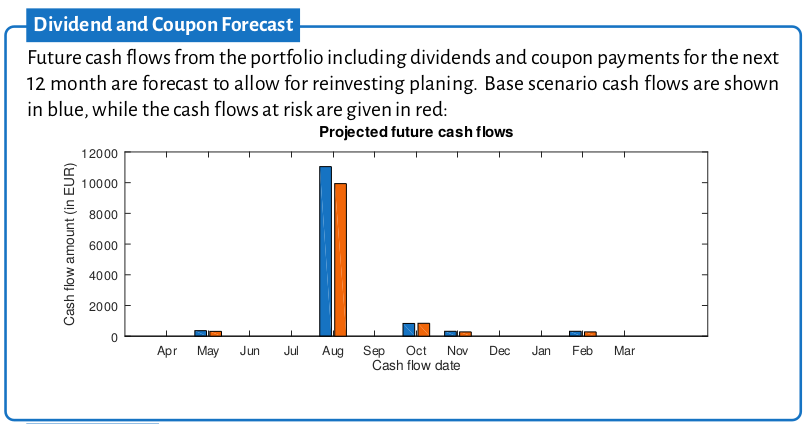

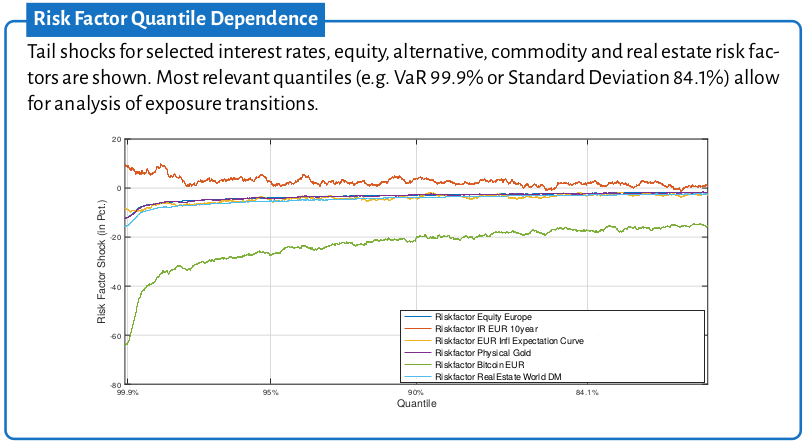

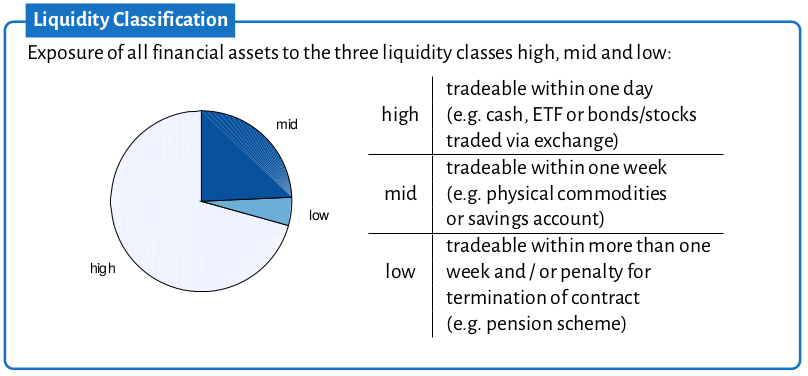

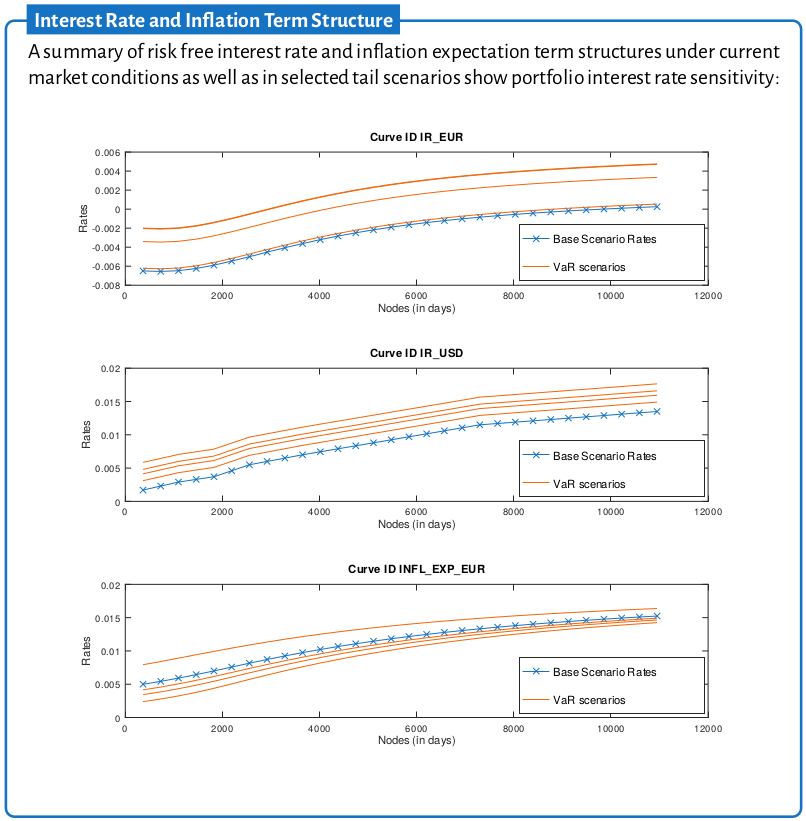

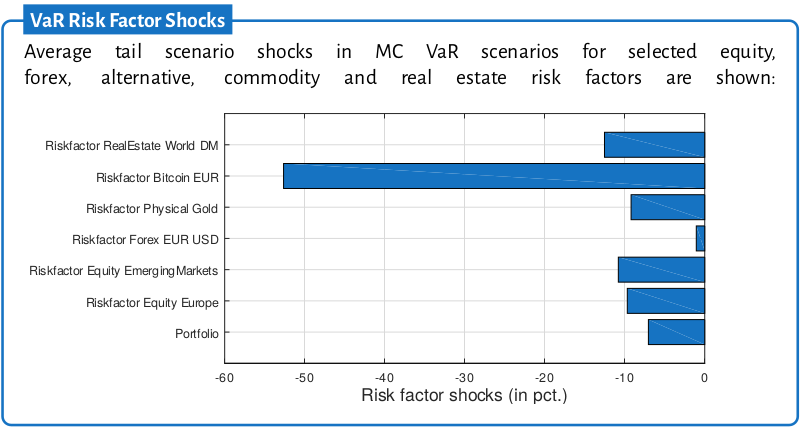

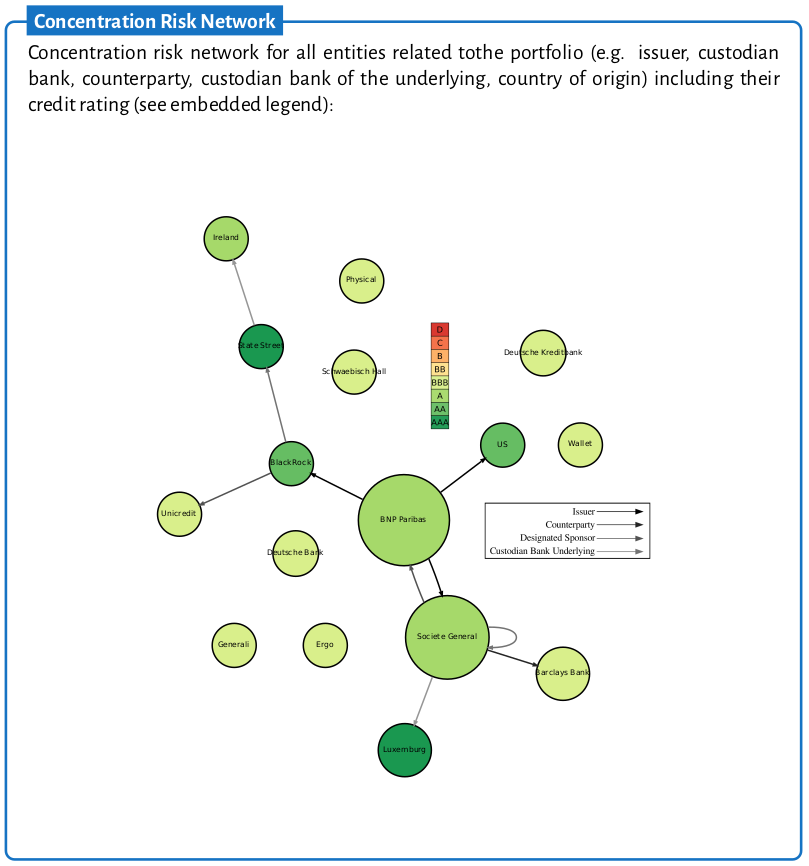

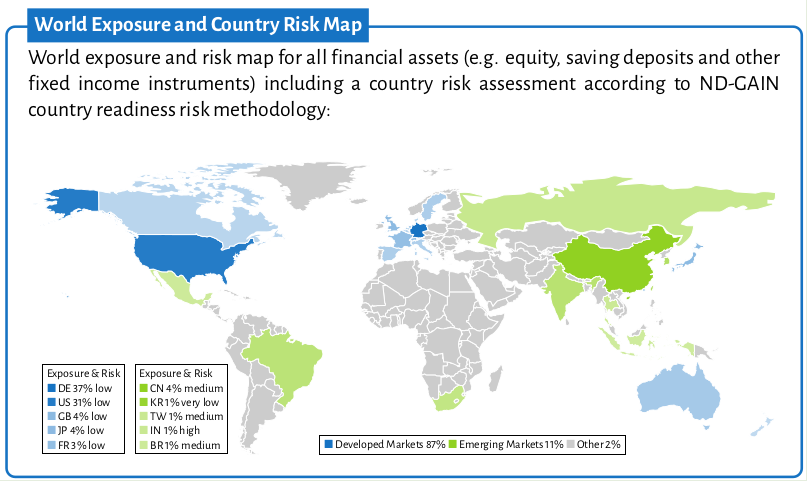

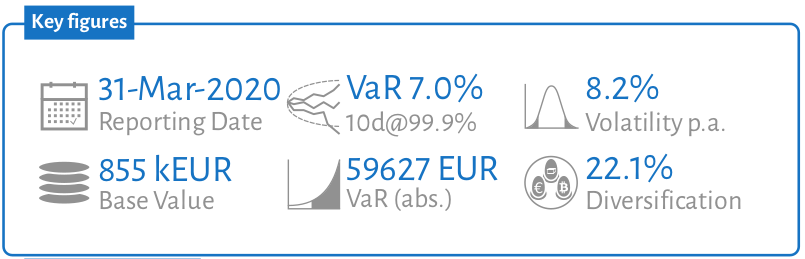

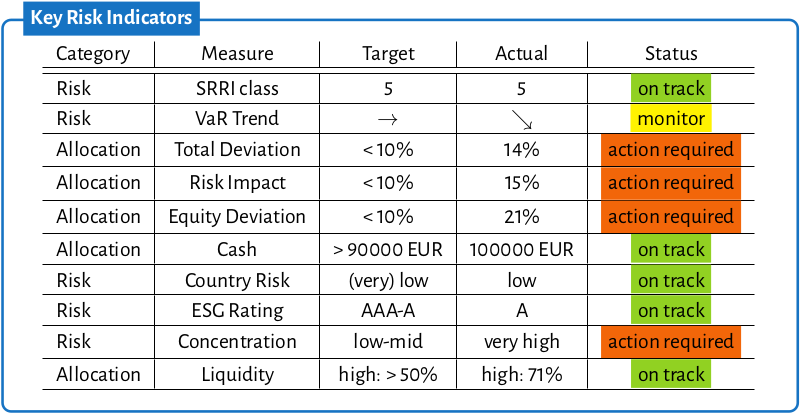

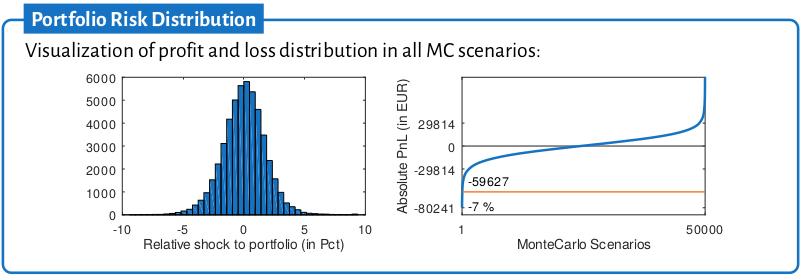

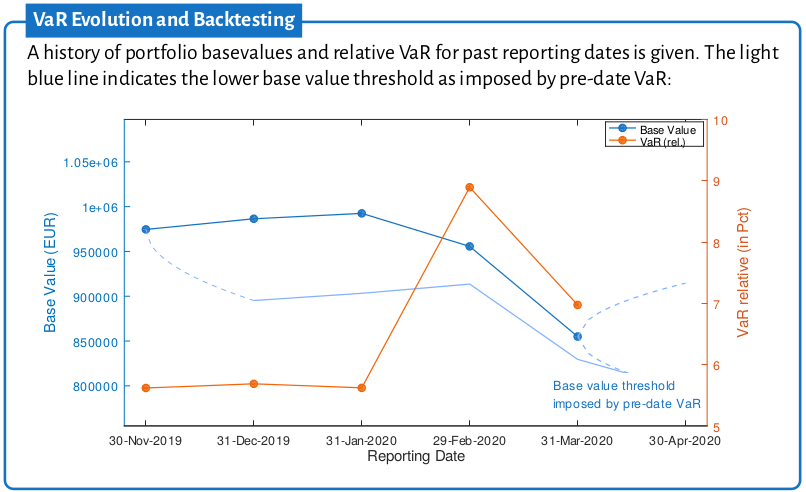

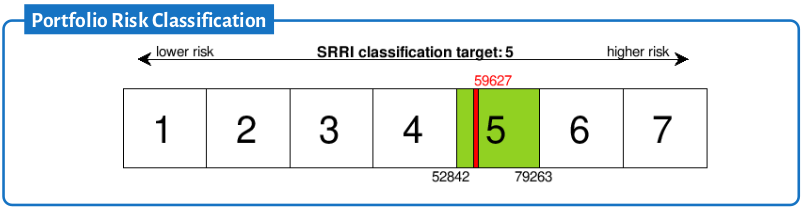

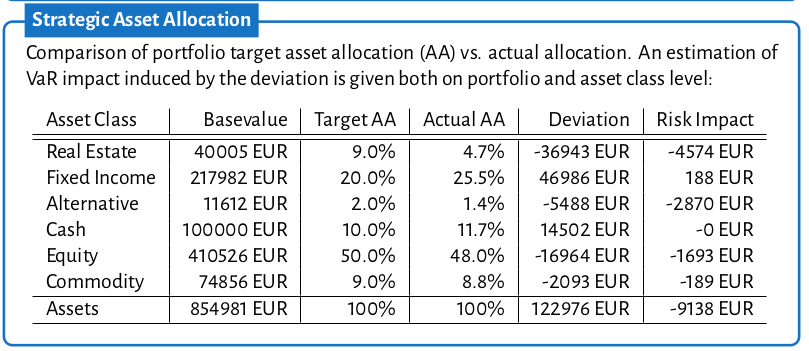

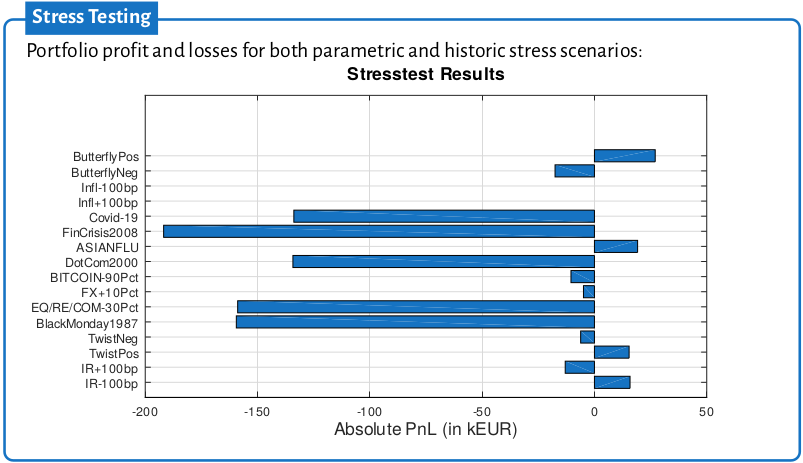

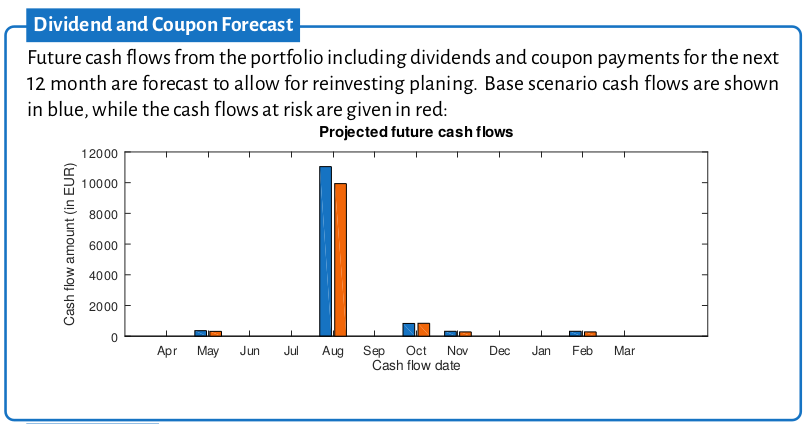

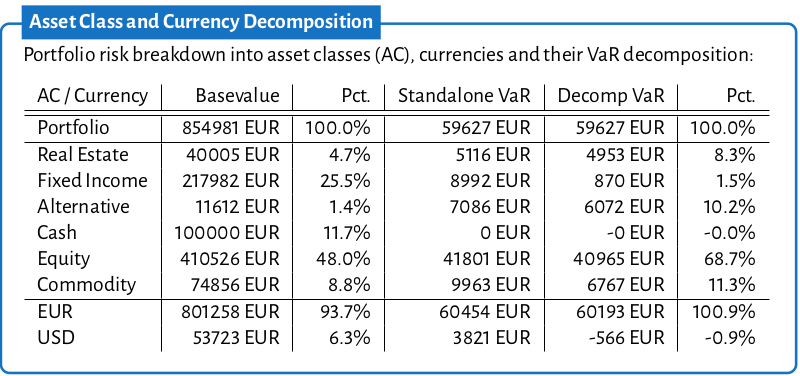

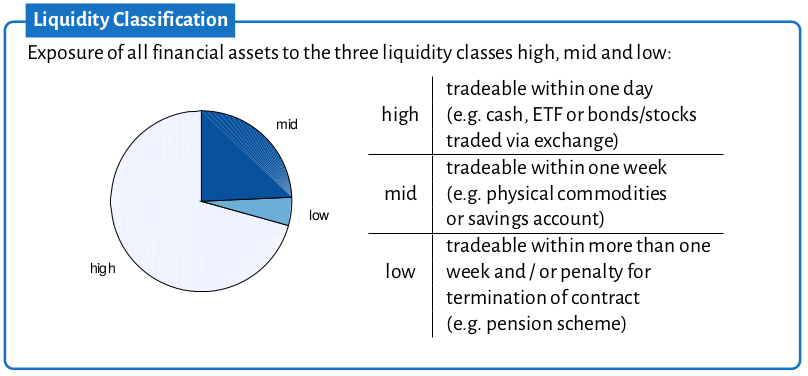

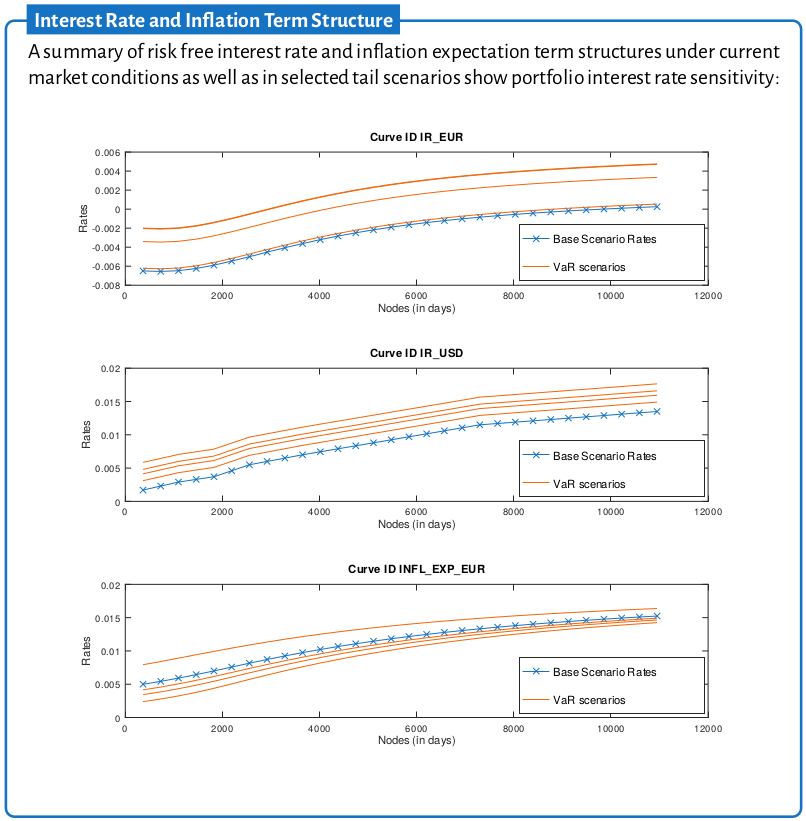

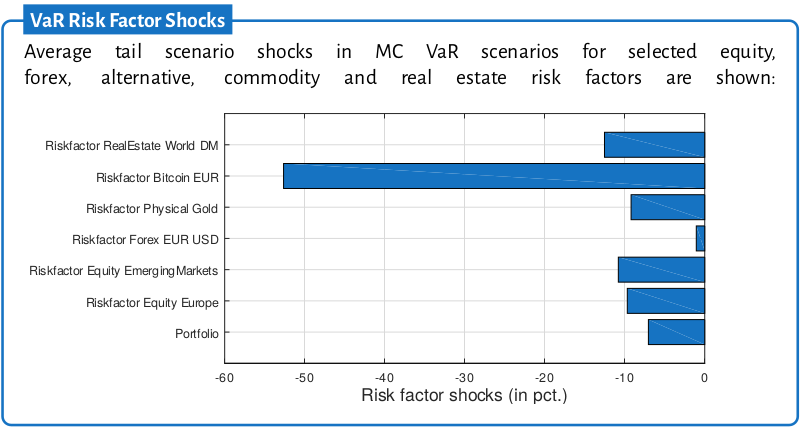

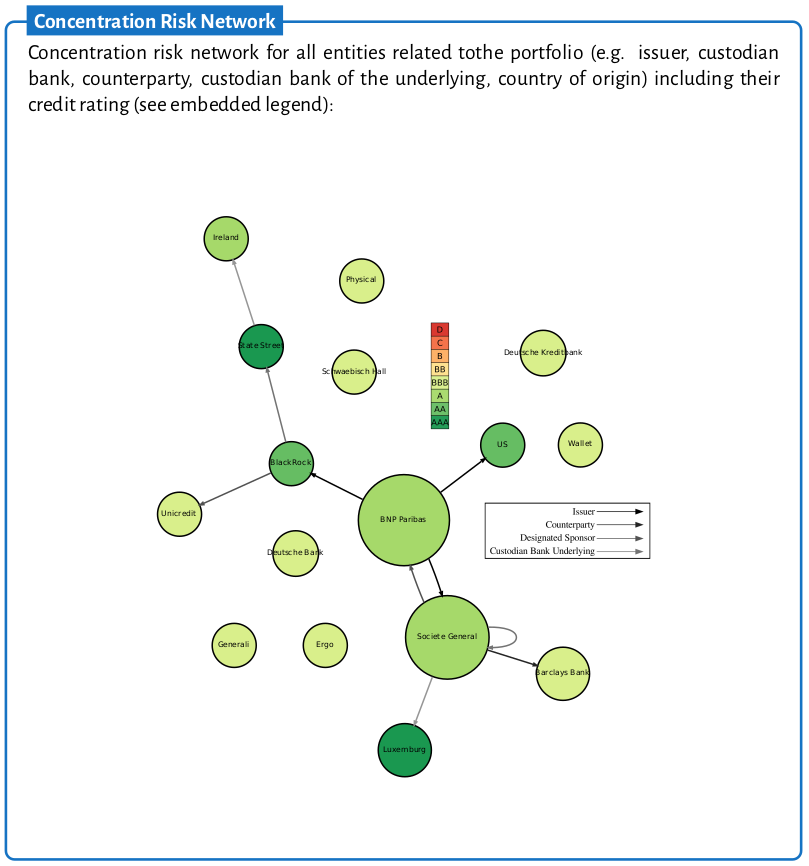

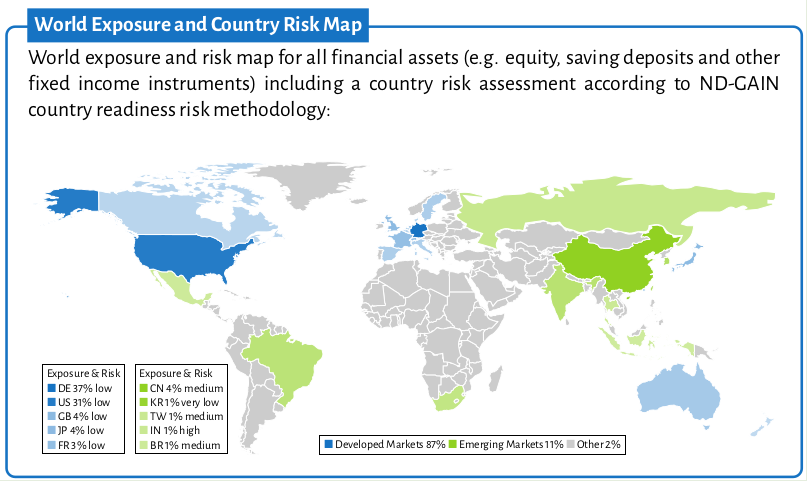

Risk reporting has to be tailored to the investment objective and should ideally adress underlying risk types, give clear indication if and where action is required and should assist in monitoring and adjusting strategic and / or tactical asset allocation. Both quantitative and qualitative aspects could be taken up by proper risk reporting and allow for historic comparison and movement analysis. With OCTARISK all these aspects of risk management can be covered in custom risk reports.

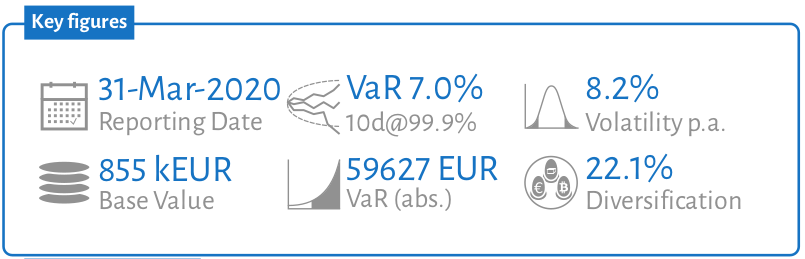

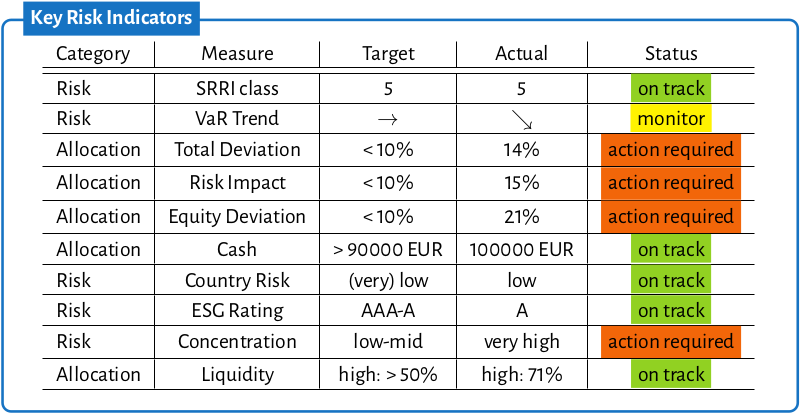

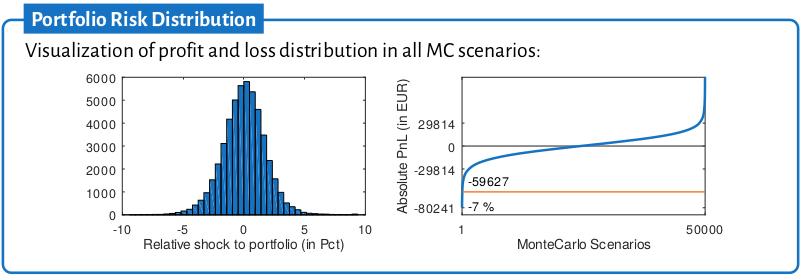

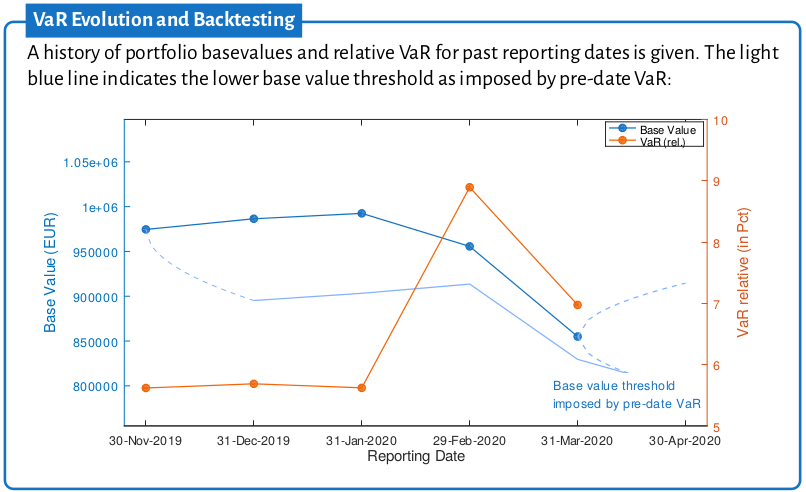

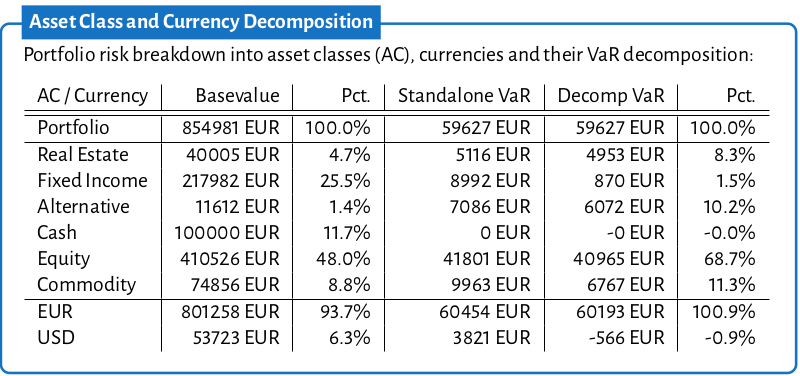

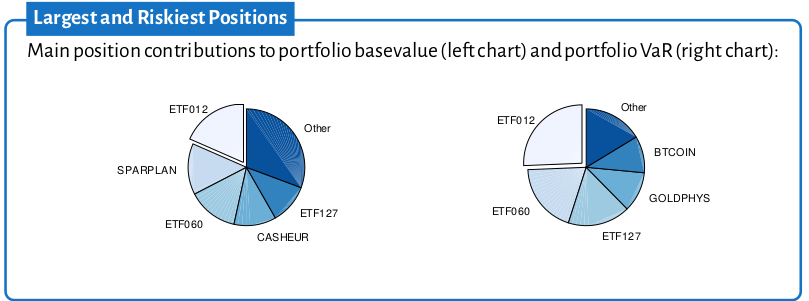

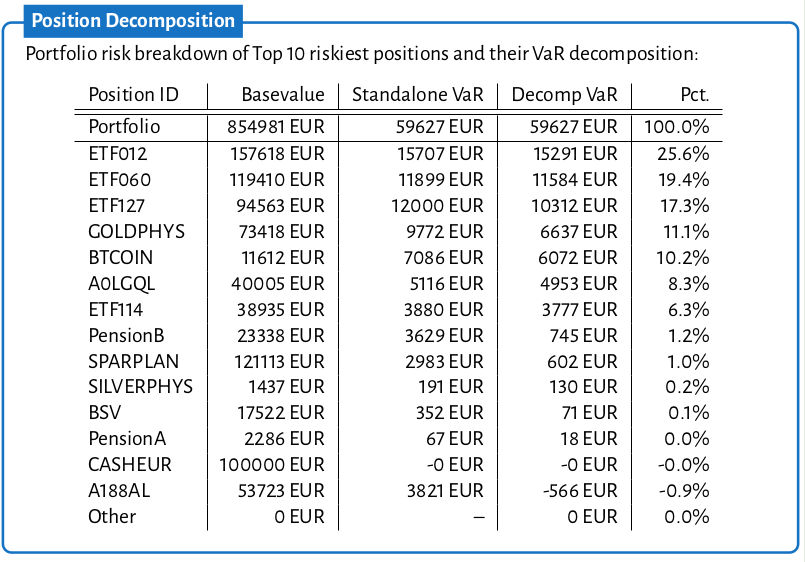

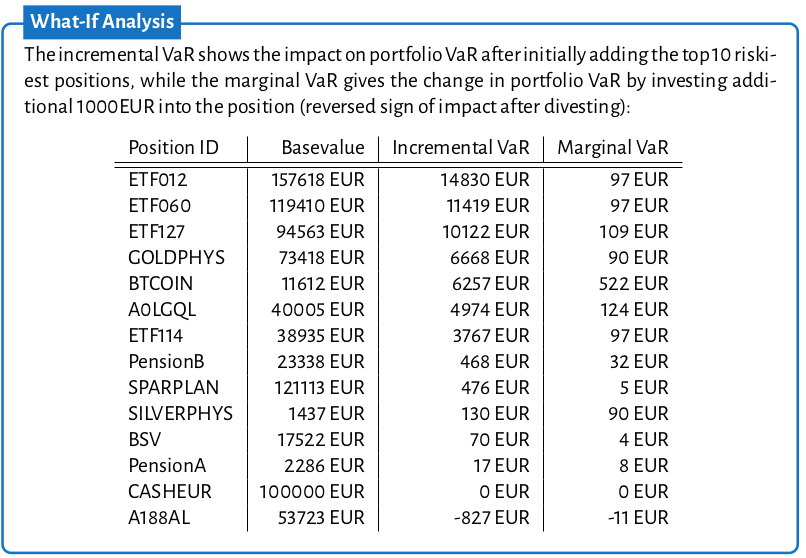

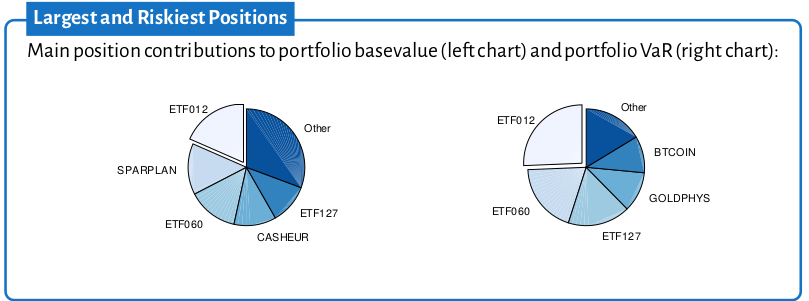

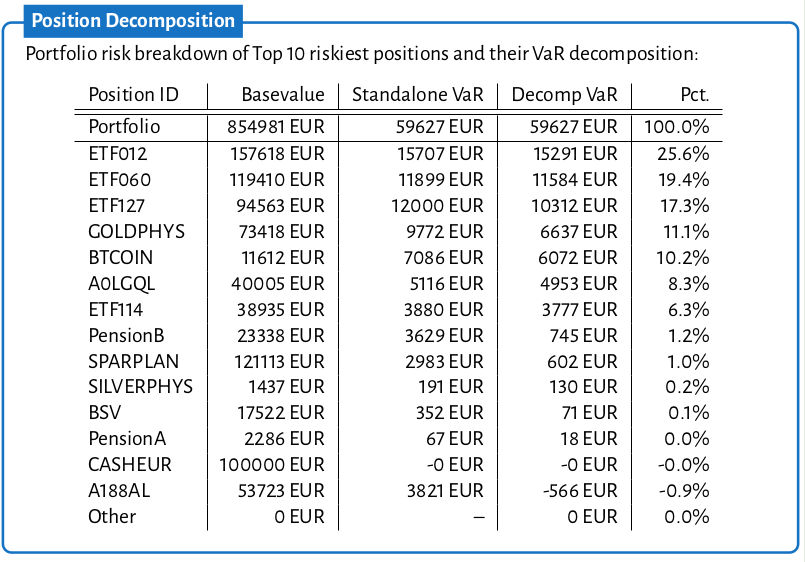

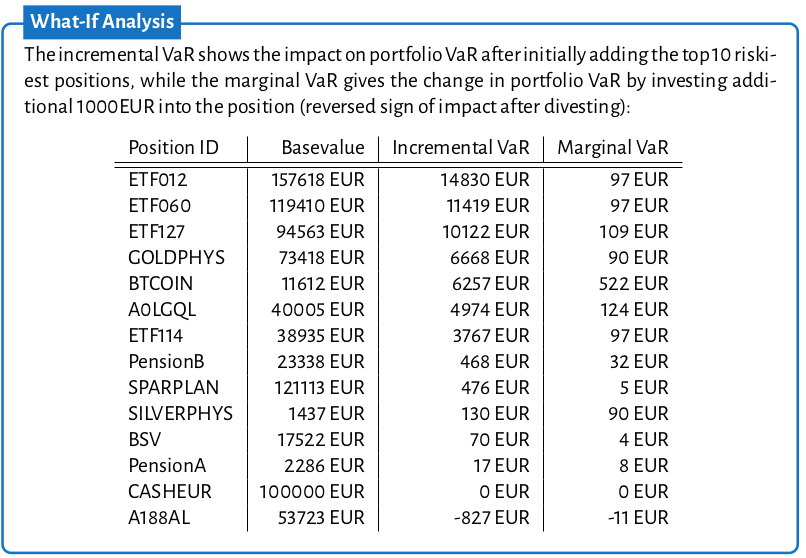

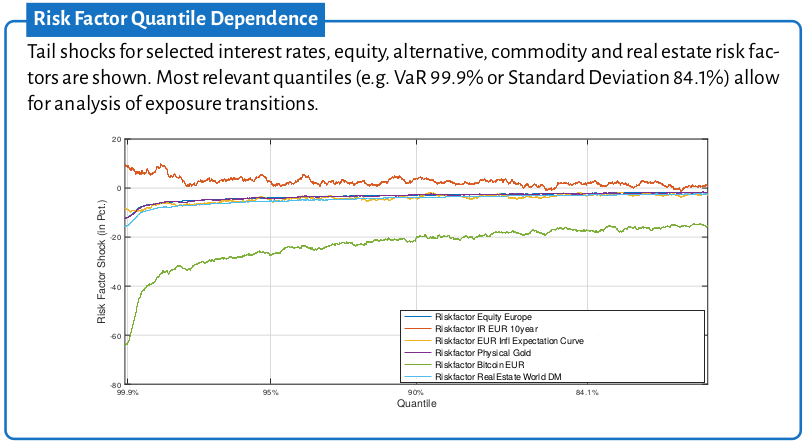

Some impressions of the reporting capabilities of OCTARISK are shown:

Octarisk can be used to perform asset data Solvency II regulatory reporting required for asset manager reporting to (re-)insurance companies. The solvency2_reporting script performs a full valuation of a portfolio and exports position attributes according to the Tripartite v4.0 industry standard.