Low Risk

Markets are functioning normally with low systemic stress.

Low (0-25)

Elevated (25-45)

High (45-65)

Critical (65+)

What does this mean?

This dashboard aggregates multiple financial stress indicators from the US Federal Reserve (FRED), European Central Bank (ECB), and Office of Financial Research (OFR). A higher score indicates greater systemic stress in financial markets, which may affect investment returns and economic stability.

Key Indicators

| Indicator | Status | |

|---|---|---|

| 🟢 | High Yield Spread | Normal |

| 🟡 | Equity Volatility | Elevated |

| 🔴 | Gold Volatility | Critical |

| 🟢 | ECB CISS Index | Normal |

| 🟢 | OFR Stress Index | Normal |

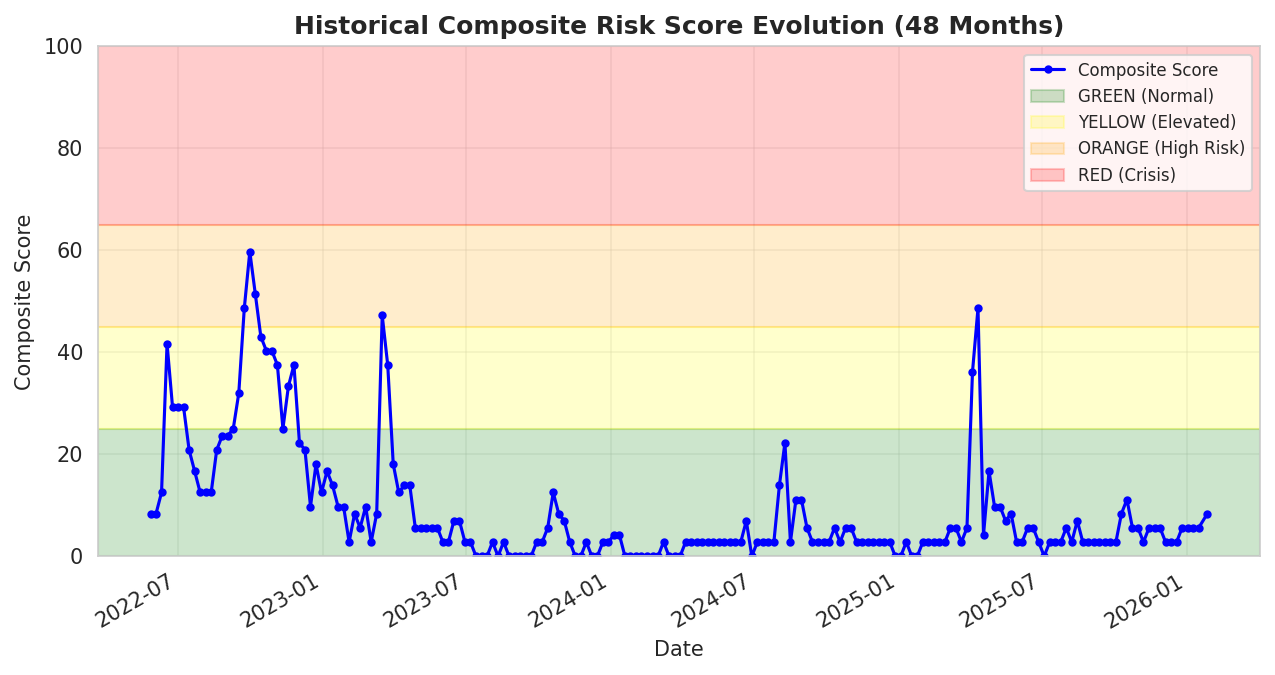

48-Month Trend

Historical evolution of the composite risk score.